How to Add Direct Deposit with tmsPay

Summary

This document describes how to add direct deposit information to an employee with tmsPay.

To Add Direct Deposit

1. From the tmsConneXion menu, select tmsPay and MyTeam (Figure 1).

2. Log in with the User Name, Password and Company ID (Figure 2).

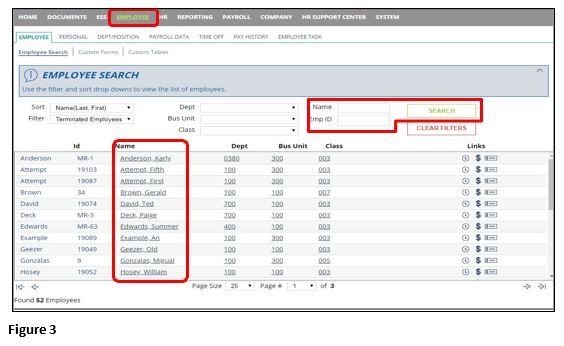

3. After logging into Pay-Net online click on the Employee tab. You can either use the Search options to find the employee or just scroll and select their Name from below (Figure 3).

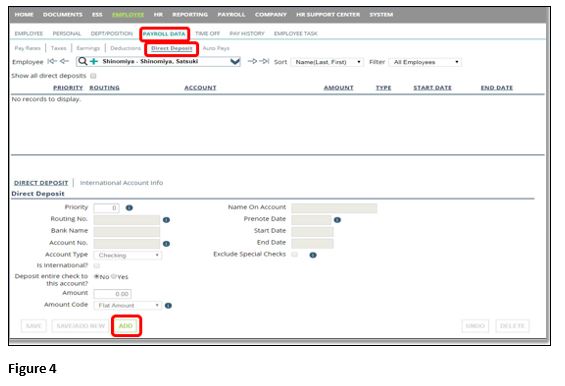

4. Click on the Payroll Data tab and the click on the subtab Direct Deposit. Click Add (Figure 4).

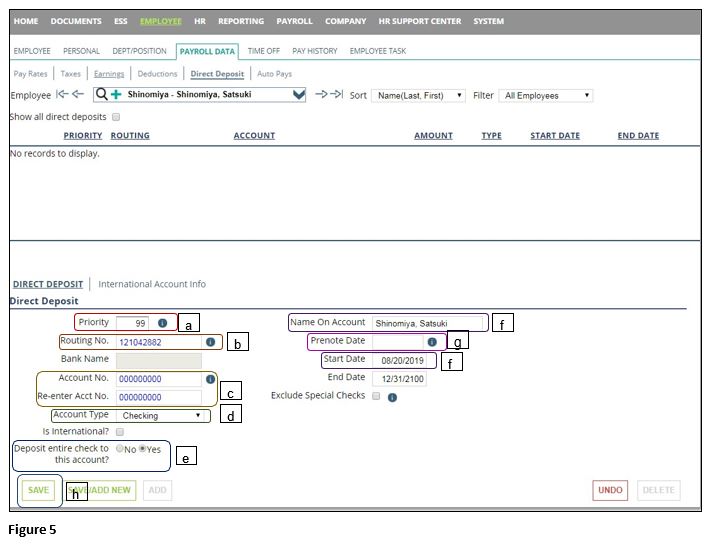

5. Enter the information for the account (Figure 5).

a). Leave the Priority 99.

b). Input the bank’s Routing Number

c). Input the Employee’s Account Number. Re-enter it for verification.

d). Mark if it is a Savings or a Checking account.

e). Mark Yes next to Deposit entire check.

f). Verify the Name and the Start Date, which auto populates with the next check date.

g). We recommend leaving the Prenote date blank as this will allow the account to verify. Please see the last page summarizing the prenote process.

h). Click Save after you have verified the information. *Note: The bank name should autofill after clicking save. If it does not it does not mean the routing number is incorrect it just means that it might not be a common bank listed in our system.

The next steps will outline how to add an additional account. You may have more than two accounts, but this guide will only show you how to add one more additional account as the steps do not change for the third and so on.

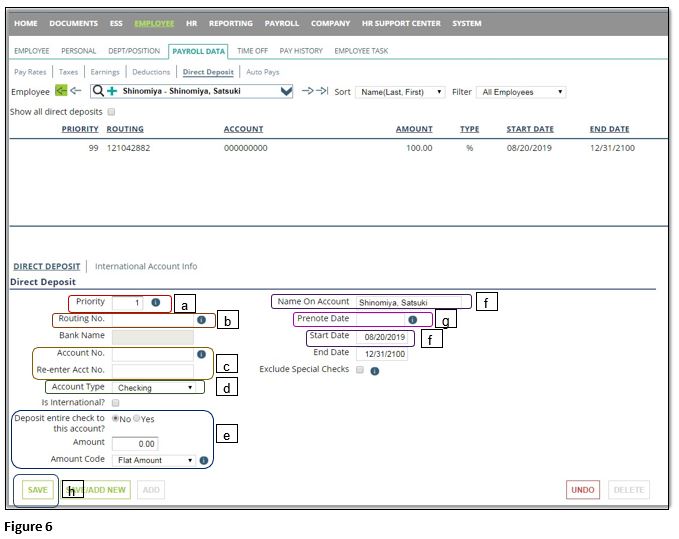

6. Enter the information for the account (Figure 6).

a. Leave the Priority 1 or change it to anything above 99 or above a number you have already used.

b. Input the bank’s Routing Number

c. Input the Employee’s Account Number. Re-enter it for verification.

d. Mark if it is a Savings or a Checking account.

e. Mark No to deposit entire check

i. Enter the dollar amount/percentage you want to go into this account. (Ex. For 5% input 5)

j. Change amount code to Flat Amount or Percent. Don’t use Flat-.

f. Verify the Name and the Start Date, which auto populates with the next check date.

g. We recommend leaving the Prenote date blank as this will allow the account to verify. Please see the last page summarizing the prenote process.

h. Click Save after you have verified the information. *Note: The bank name should autofill after clicking save. If it does not it does not mean the routing number is incorrect it just means that it might not be a common bank listed in our system.

7. For the Second account, where the rest of the funds will be deposited, follow Step 3 as this will have 100% of what is left over going into the Priority 99 account.

Example: If 30% goes into one account, this is Priority 1 or 98, follow Step 6, and then for the second account where 70% goes, still put 100% as the rest will go into the Priority 99 account, follow Step 5. If you put 30% and 70%, instead of 30% and 100%, then there is a chance of a live check being created for a penny or so due to rounding.

Prenote Process:

The prenote process is a verification process in which the ACH Company we partner with verifies the employee account(s) with the employees’ banks. They make sure the account is active, correct, not frozen, etc. Depending on your payroll frequency, the process takes 7-14 days. We do not recommend bypassing this process, but you do have the ability to override the date. If you want to bypass the prenote process so the employee’s first check goes direct deposit put in a date that is a month before the next check date, to ensure it bypasses. It is alright if this date is before the start date. We recommend only doing this if you are 100% sure that the account is active and if they provide you with a copy of a bank statement with the information or a voided check from the bank. Deposit Slips have a different routing number that cannot be used for ACH transactions.

If the prenote fails we receive notification a minimum of 2 business days after your check date and will make you aware of the issue with the account. Please be aware that if you bypass the prenote we will not receive this notification.